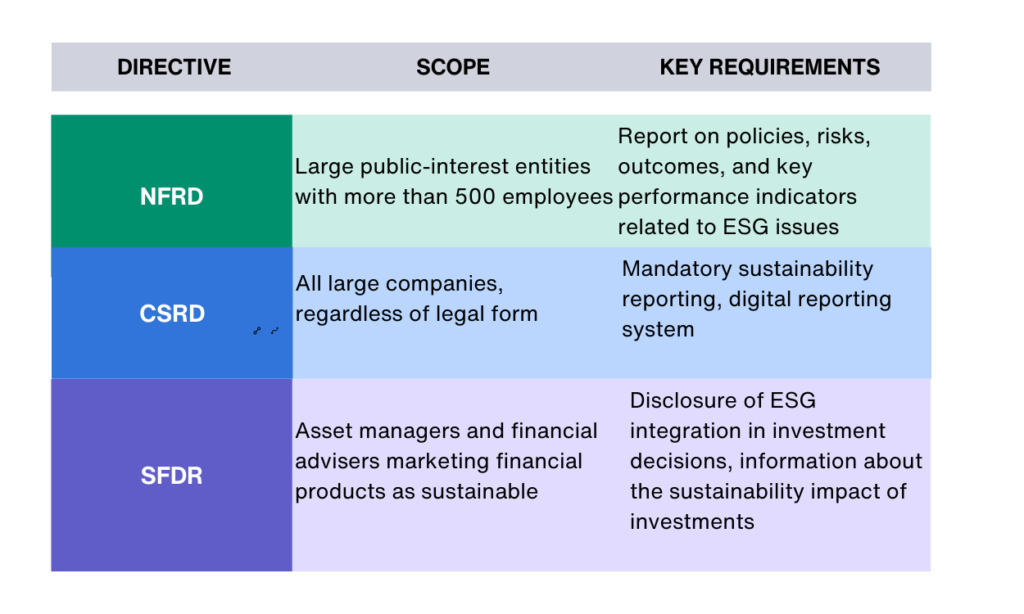

EU legislation mandates that all large companies and publicly traded companies (excluding listed micro-enterprises) must report on the risks and opportunities they perceive in social and environmental matters, as well as the effects their operations have on people and the environment. This requirement enables investors, civil society groups, consumers, and other stakeholders to assess companies’ sustainability performance, supporting the European Green Deal. The Corporate Sustainability Reporting Directive (CSRD) is an EU directive that revises the scope and reporting requirements of the Non-Financial Reporting Directive (NFRD). Unlike the NFRD, which only provides ESG reporting guidelines, the CSRD establishes mandatory reporting standards. Let’s explore more about the CSRD.

On April 21, 2021, the EU Commission announced the adoption of the Corporate Sustainability Reporting Directive (CSRD) as part of its commitment to the European Green Deal. The CSRD modifies the Non-Financial Reporting Directive (NFRD) to significantly enhance the reporting requirements for the companies it covers, thereby broadening the sustainability information available to users. The CSRD officially took effect on January 5, 2023, updating and reinforcing the regulations on companies’ disclosure of social and environmental information. This change requires a broader range of large companies, as well as listed small and medium-sized enterprises (SMEs), to report on their sustainability efforts. Additionally, some non-EU companies must comply if they generate more than EUR 150 million in the EU market.

The new regulations ensure that investors and other stakeholders can access the necessary information to evaluate companies’ impacts on people and the environment, as well as to assess financial risks and opportunities related to climate change and further sustainability topics. The CSRD requires all disclosures to be publicly accessible and mandates third-party audits to ensure accuracy and completeness. Additionally, all CSRD reporting must adhere to the standard of double materiality.

Companies subject to the directive must enhance the quality and comparability of their sustainability reporting to meet the new standards, which will help them identify ESG risks and opportunities within their operations. The more detailed and standardized reporting mandated by the CSRD can assist investors in making better-informed investment decisions and identifying ESG risks and opportunities within their investment portfolios.

The first companies must adhere to the new rules starting in the 2024 financial year, with reports due in 2025. The Corporate Sustainability Reporting Directive affects nearly 50,000 companies across the European Union that meet specific size and reporting criteria. By 2028, all the following organizations must comply with the CSRD. Here’s an overview of the impacted groups:

Large entities based in the EU, whether listed or unlisted. A large entity is defined by meeting at least two of the following criteria on consecutive balance sheet dates:

These parent companies must also meet at least one of the following conditions:

The CSRD imposes reduced reporting obligations on SMEs, especially those not listed publicly. Here’s the impact on SMEs:

Companies whose securities are traded on an EU-regulated market, except for micro-entities that do not meet two out of the following three size criteria for two consecutive balance sheet dates, are subject to this regulation:

CSRD compliance is being introduced gradually from 2024 to 2029, primarily based on the legacy of the NFRD or the size of the company.

The Non-Financial Reporting Directive (NFRD) was introduced in 2014 to enhance the transparency and accountability of large EU companies regarding their non-financial performance. This directive mandates companies to disclose various non-financial aspects, encompassing environmental, social, and governance (ESG) factors. The objective is to furnish investors and other stakeholders with more consistent and comparable information concerning a company’s ESG performance, thereby aiding them in making more informed decisions.

Under the NFRD, companies are obliged to furnish a non-financial statement detailing their policies, risks, and outcomes related to ESG matters. This statement should be incorporated into the company’s annual report, which must be publicly accessible on the company’s website. Additionally, the statement should be audited by an independent auditor or subjected to external verification.

In 2021, the European Parliamentary Research Service identified various shortcomings in the information collected under the NFRD. These included inconsistencies and lack of comparability in the data, potentially hindering sustainability investments and increasing data costs for stakeholders. The CSRD proposes significant changes and updates to the existing NFRD to address these issues. Firstly, it broadens the scope of sustainability reporting by mandating companies to report on additional topics such as human rights, supply chain due diligence, and biodiversity.

Secondly, it introduces new reporting standards to be formed by the European Financial Reporting Advisory Group (EFRAG) in collaboration with the European Commission. Companies will be obliged to adhere to these standards, ensuring consistency and comparability in reporting. Lastly, the CSRD introduces requirements for digital reporting, striving to improve the accessibility and availability of sustainability information.

In summary, the CSRD extends upon the NFRD in several significant aspects. Here are some key distinctions:

The Sustainable Finance Disclosure Regulation (SFDR), implemented in March 2021, aims to foster sustainable investments by mandating asset managers and financial advisers to disclose information concerning their investments’ environmental and social impact. By necessitating financial market participants to divulge details on the sustainability impact of their investments, the SFDR enhances transparency and accountability in the financial sector. This facilitates consumers in making more informed decisions regarding where they invest their money, aligning with their values and beliefs.

For companies obligated to adhere to the SFDR, the regulation offers a framework for integrating sustainability risks and opportunities into their investment decision-making procedures. This aids them in pinpointing ESG risks and opportunities within their operations. By providing a standardized approach to disclosing the sustainability impact of their investments, the SFDR assists investors in making more informed investment decisions and identifying ESG risks and opportunities within their investment portfolios.

Companies subject to the CSRD are required to report in accordance with European Sustainability Reporting Standards (ESRS). These standards are developed by the EFRAG, an independent entity that brings together various stakeholders. ESRS aims to offer a comprehensive framework for companies to report on their sustainability performance, enclosing ESG aspects. The inaugural set of ESRS was published in the Official Journal on December 22, 2023, as a delegated regulation. These standards apply to companies falling within the scope of the CSRD, regardless of their sector of operation. They are specifically tailored to align with EU policies while contributing to and building upon international standardization initiatives.

In February 2024, EU institutions agreed to postpone the deadline for adopting sector-specific European Sustainability Reporting Standards (ESRS) by two years. It is anticipated that sector-specific ESRS will be issued by June 2026. However, this delay does not affect the effective dates of the CSRD. While the CSRD sets out the overarching framework for sustainability reporting, ESRS offer detailed reporting standards to facilitate CSRD compliance. The CSRD constitutes a crucial element of the EU’s sustainable finance action plan, aligning with the objectives of the European Green Deal and the transition to climate neutrality by 2050.

Under the CSRD, companies reporting will be mandated to align with the EU taxonomy, ensuring enhanced consistency and comparability in reporting. Additionally, the CSRD incorporates other frameworks like TCFD, GRI, and SASB, ensuring a comprehensive approach to sustainable disclosure. Moreover, the indicators outlined in the SFDR standards will be harmonized with CSRD reporting, providing financial market stakeholders with robust and trustworthy data on the sustainability of invested companies. SFDR regulates how financial market participants disclose sustainability information, and CSRD ensures that companies report the information required to comply with SFDR reporting requirements.

Creating an ESG report that fulfills CSRD requirements presents its own set of challenges and opportunities:

Crafting suitable ESG reporting poses a significant hurdle for numerous organizations. The array of ESG metrics is extensive and differs based on industry, company size, and complexity. Moreover, there exist various measurement and reporting frameworks globally. At EcoSkills, we assist you in readying yourself to produce an ESG report compliant with CSRD regulations, encompassing the EU Taxonomy and the Task Force on Climate-Related Financial Disclosures (TCFD).

There are numerous advantages to early compliance with CSRD:

The CSRD mandates EU member states to establish an investigative and compliance body to enforce effective, proportionate, and deterrent penalties. These penalties consider factors such as the severity and duration of the breach and the company’s financial position. Individual member states determine non-compliance penalties under the CSRD according to their respective laws. Every company needs to remain abreast of legislative changes and seek legal counsel to ensure compliance, thus mitigating the risk of investigations and potential penalties.

To adequately ready themselves for the CSRD, once assembling a diverse team and engaging in discussions with stakeholders, businesses should proceed with the following steps: