ESG reporting involves sharing information about a company’s environmental, social, and governance practices. It aims to enhance transparency for investors and encourage other businesses to follow suit. By disclosing ESG activities, companies can showcase their commitment to meeting goals and ensuring authenticity in their projects. The key pillars of ESG include environmental responsibility, social impact, and strong governance.

The environmental aspect of ESG concentrates on how a business manages its impact on the planet, including efforts to reduce greenhouse gas emissions, preserve biodiversity, and handle waste responsibly. Social considerations delve into how a company affects society, examining aspects such as diversity, inclusion, human rights, and supply chain practices. Governance looks at how a company is managed and overseen, encompassing areas like executive pay, board practices, and data security measures.

In today’s financial landscape, businesses face intense scrutiny from stakeholders, with their reputations directly impacting financial performance. Investors increasingly prioritize ESG metrics to assess companies’ viability and alignment with their values. A robust ESG strategy not only ensures compliance with regulations but also identifies opportunities and risks while prioritizing stakeholder interests. Through transparent ESG reporting, companies can demonstrate progress toward goals outlined in their strategy, keeping stakeholders informed about its significance and outcomes.

In recent years, the ESG framework for assessing company sustainability has shifted from a specialized concept to a mainstream business priority. Properly embracing this strategic imperative can lead to enhanced stakeholder engagement, increased resilience, and prolonged organizational success. Today, ESG considerations are integral to investment decisions, reflecting investors’ preferences for socially responsible and financially stable companies.

ESG considerations have gained widespread acceptance, driven by heightened expectations for companies to prioritize sustainability and social responsibility. This trend has spurred the development of ESG ratings and indices, which investors and other stakeholders increasingly utilize to assess companies based on their ESG performance. The increasing accessibility of ESG data and research has played a crucial role in mainstreaming these practices, facilitating the standardization of ESG metrics, and simplifying the evaluation process for investors.

Regulatory bodies have been actively involved in advancing transparency and accountability in ESG practices. ESG regulations encompass government-mandated standards for actions, reporting, or disclosures related to sustainability and ethics aimed at assessing a company’s impact. While navigating sustainability reporting regulations may pose challenges, there’s a global push towards enhancing consistency, precision, and clarity in disclosure mandates, marking significant progress in this arena.

According to research conducted by ESG Book, ESG regulation has surged by 155% in the last ten years, indicating a substantial rise in policies centered around sustainability. This data underscores the swift expansion of interventions to foster sustainable practices across diverse sectors.

Why is ESG reporting important? According to insights from Clouds on Mars, quality ESG reporting offers organizations three key advantages: effectiveness, transparency, and compliance. Effectiveness relates to the positive financial impact of ESG reporting, while enhanced transparency and compliance lead to better risk management in operations and investments. Companies embracing ESG disclosures tend to mitigate risks like litigation or adverse market reactions. Conversely, a lack of ESG disclosure can lead to investments in high-risk sectors with potential environmental or social harm, posing risks to both the company and its stakeholders.

Through ESG Reporting, a company can:

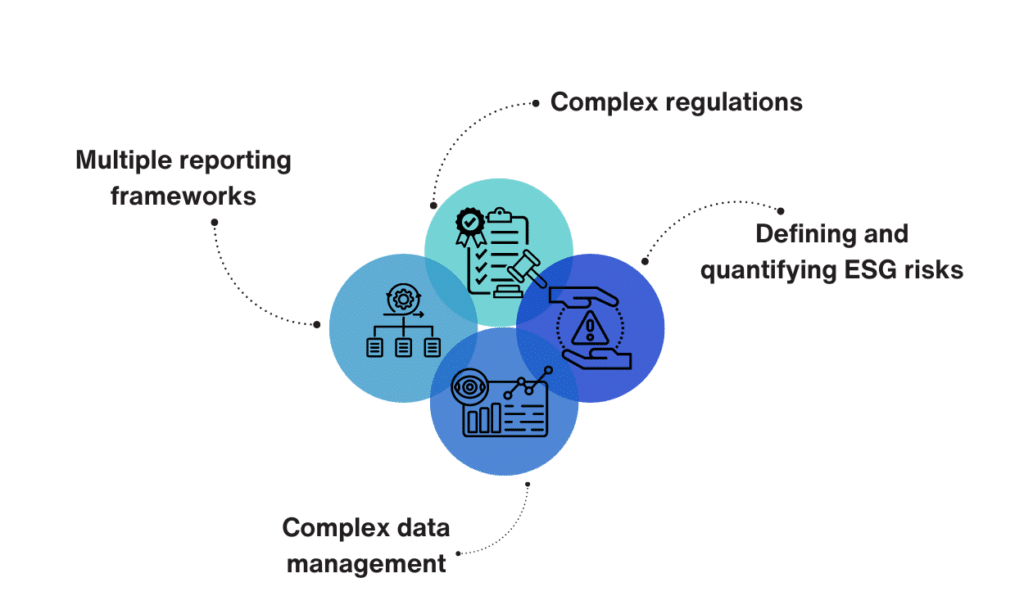

As the ESG landscape evolves, navigating through a maze of shifting global objectives, expanding regulations, heightened stakeholder demands, and the imperative for standardized reporting presents four primary challenges, as outlined by Bedford Consulting:

Some best practices to address these challenges are the following:

Despite recognizing the significance of ESG reporting, many individuals and businesses need more expertise for effective implementation, posing a considerable obstacle to reaping its benefits. Bridging this gap requires specialized education and training tailored to ESG reporting. Certified programs like the EcoSkills ESG Reporting course are specifically designed to equip participants with the practical skills and knowledge essential for successful implementation in both personal and organizational contexts.

The certified course offers a comprehensive pathway for crafting detailed ESG reports, a critical tool for communicating a company’s sustainability efforts to stakeholders and rating agencies alike. This course is diligently designed for sustainability professionals, entrepreneurs, and recent graduates eager to master the complexities of ESG reporting and stay informed about the sector’s latest trends.

In this course, you can explore essential legislative and regulatory reporting requirements and introduce a methodical approach to ESG reporting. It provides valuable techniques to enhance the efficiency and impact of your organization’s reporting processes. Participants will become adept in using major ESG standards such as GRI and SASB and learn how to align their reporting efforts with the Sustainable Development Goals.

In recent years, the importance of ESG reporting has surged, evolving from a niche concern to a cornerstone of contemporary business practices. With growing demands for transparency and ethical governance, ESG reporting has emerged as a central element in corporate strategies and stakeholder relations. It now serves as a vital tool for businesses to prove their commitment to sustainability and ethical conduct.

Looking ahead, the future of ESG reporting will be marked by increased integration of technology, adherence to regulations, and alignment with sustainability objectives. Companies embracing these changes stand to boost their operational efficiency and market competitiveness. Conversely, neglecting sustainability needs reflects short-term thinking, prioritizing immediate profit gains over long-term viability. Avoiding this trap is crucial for fostering lasting value creation beyond quarterly returns.