For more than 20 years, there has been a growing demand for information in the field of sustainable development from various stakeholders. The assessment of the ESG performance of companies and the making of ESG-oriented decisions by organizations and their stakeholders are becoming the norm because of the consistent implementation of the sustainable development agenda globally. As a result, investors are requesting data disclosure from more corporations.

ESG reporting pertains to the public disclosure of an organization’s environmental, social, and corporate governance data. The objective of the ESG report is to ensure transparency regarding the organization’s environmental, social, and governance (ESG) initiatives and assess its sustainability performance, thereby enabling stakeholders to make more responsible and well-informed choices.

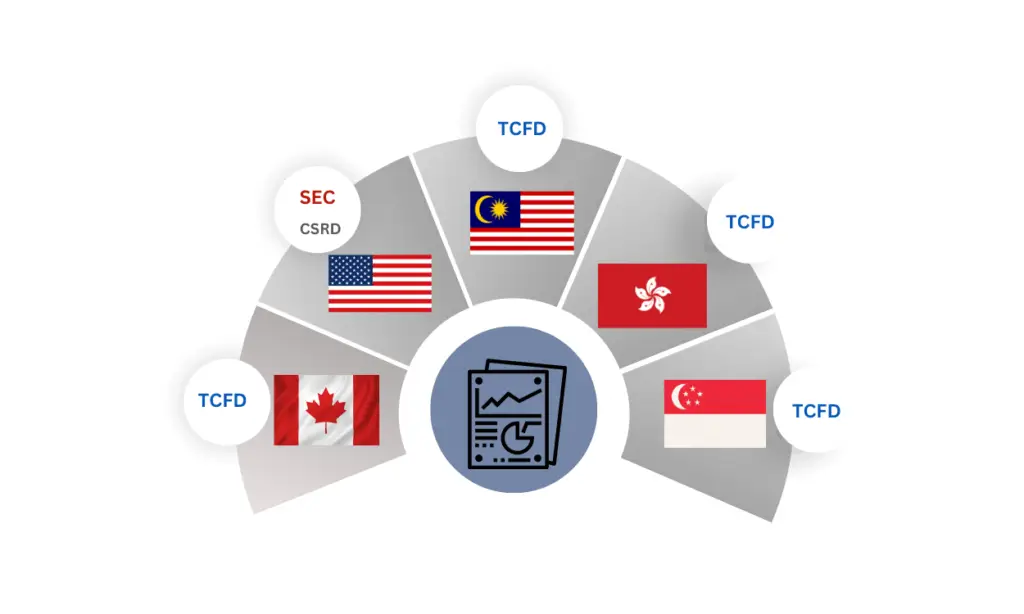

The proliferation of governmental legislation requiring ESG reporting in recent years, as well as the increasing prevalence of mandatory ESG rules globally, have both supported the importance of ESG reporting.

The development of European Union sustainability disclosure guidelines aims to facilitate the decision-making process for firms about the disclosure of relevant data in their non-financial reporting.

In June 2022, the European Parliament, along with the European Council, reached a temporary agreement on setting required reporting criteria on environmental, social, and governance issues for large companies and listed SMEs from 2024 onwards.

On November 28, 2022, the European Union Council gave its final approval to the Corporate Sustainability Reporting Directive (CSRD), and the CSRD entered into force on January 5, 2023. Member states were supposed to implement the new rules within a period of 18 months. In October 2024, the European Commission initiated infringement procedures against 17 Member States that had failed to fully incorporate the CSRD into their national laws. This urged these Member States to speed up the process, and by the end of 2024, CSRD had been incorporated into national laws.

But first, let’s get to know what CSRD is.

The Corporate Sustainability Reporting Directive (CSRD) is EU legislation that requires all large companies and listed SMEs to produce regular reports on their environmental and social activities’ impact.

Thus, all stakeholders, like consumers, policymakers, or investors, will be able to evaluate large companies’ non-financial performance. These companies are encouraged to develop more responsible business approaches to satisfy their stakeholders and enhance their overall performance.

It is the first time that the EU has defined a common reporting framework for non-financial data.

For the companies to comply with the rules, it is imperative that an independent auditor certifies the compliance of the sustainability information with the new standards.

The reporting of non-European companies must also be certified, either by a European auditor or by one established in a third country.

As part of CSRD compliance, reporting companies will need to use the European Sustainability Reporting Standards (ESRSs). The ESRSs are considered quite demanding in scope and depth, and compliance is already viewed as a significant challenge for companies, especially for those that have not published an ESG report in the past.

For most reporters, it is crucial to understand how the ESRS fits with the existing reporting practices, namely the GRI (Global Reporting Initiative) Standards. Towards this, the GRI has published a ESRS-GRI data point mapping and a GRI-ESRS interoperability index.

The Corporate Sustainability Reporting Directive (CSRD) is here to alter the way ESG reporting is being done so far. From 2025 onwards, almost 50,000 listed companies are about to start publishing their sustainability reporting (ESG Disclosure) annually and mandatorily, including non-EU companies with subsidiaries that operate within Europe or are listed on EU-regulated markets.

Beginning in 2025, companies will have to report on hundreds of metrics and targets. This will be a challenge due to the extra time and resources it will take for the required data to be collected and processed. Companies should receive the right information while relying on third parties, while at the same time, the number of disclosure requirements will increase, and the company will be required to step up in providing data.

Social issues, such as the way employees are treated, must be discussed openly both within the company and with partners in the supply chain. The CSRD’s “rebuttable presumption” assures that all information must be provided unless it is found to be unrelated to the business’s operation. Each reporting area needs evidence to back up the non-materiality assertion.

What are the next steps for EU companies?

USA

In the U.S., the SEC’s climate disclosure rules adopted in 2023 are facing legal challenges that could prevent their implementation during President-elect Donald Trump’s second term. This uncertainty has complicated planning and preparation for U.S. public companies. Despite the pending court decisions and changes in administration, companies should continue preparing for other climate-related disclosure requirements, such as California’s legislation and initiatives in other states. President-elect Trump’s policy priorities for his second term, expected to be unveiled throughout 2025, will provide more clarity on the future of green energy initiatives and federal climate reporting.

On December 11, 2024, the U.S. Court of Appeals for the Fifth Circuit ruled, in a narrow 9-8 decision, that the SEC exceeded its authority by approving Nasdaq’s board diversity rules. These rules required Nasdaq-listed companies to (i) disclose a standardized matrix of their board’s gender and racial/ethnic composition and (ii) maintain a minimum number of women and diverse directors or explain the lack of such diversity. The challenge was brought by the National Center for Public Policy Research, a conservative think tank, and the Alliance for Fair Board Recruitment, a nonprofit advocating for race- and gender-neutral board member recruitment. While compliance with these rules is no longer mandatory, U.S. public companies are likely to continue providing voluntary board diversity disclosures to meet investor expectations.

Canada

Canada’s journey toward mandatory climate-related disclosures began in 2021 with a directive from Prime Minister Justin Trudeau instructing cabinet ministers to develop a reporting system aligned with the Task Force on Climate-related Financial Disclosures (TCFD). In 2022, the government announced that the financial regulator, OSFI, would require federally regulated financial institutions to publish climate disclosures consistent with the TCFD framework starting in 2024. Building on this momentum, the government reaffirmed its commitment to expanding mandatory climate disclosures in its November 2023 Fall Economic Statement.

The TCFD’s responsibilities were transitioned last year to the IFRS Foundation’s International Sustainability Standards Board (ISSB). In line with this shift, the Canadian government plans to amend the Canada Business Corporations Act to mandate climate-related financial disclosures and will initiate a regulatory process to define the requirements and determine which companies will be subject to them.

The government clarified that small- and medium-sized businesses would be exempt from these requirements, though it is exploring ways to encourage voluntary climate-related disclosures from these entities.

Malaysia

In 2024, Malaysia’s Securities Commission (SC) has introduced the National Sustainability Reporting Framework (NSRF), which adopts the standards issued by the International Sustainability Standards Board (ISSB) as the baseline for sustainability reporting in the country. The NSRF applies to listed issuers on Bursa Malaysia’s Main and ACE Markets, as well as large non-listed companies (NLCos) with annual revenues of RM2 billion or more.

The implementation of the new reporting requirements will be phased as follows:

Hong Kong

In late 2024, the Hong Kong Institute of Certified Public Accountants (HKICPA) announced the release of new sustainability and climate-related reporting standards, which will serve as the foundation for Hong Kong’s upcoming corporate disclosure requirements.

The standards, HKFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and HKFRS S2 Climate-related Disclosures, are aligned with the International Sustainability Standards Board’s (ISSB) S1 and S2 standards. According to the HKICPA, these new standards fully adhere to the ISSB framework. Their release follows the Hong Kong government’s recent publication of its Roadmap on Sustainability Disclosure, detailing plans for implementing sustainability reporting requirements.

Under the roadmap:

Singapore

Singapore has made significant progress in translating its climate ambitions into actionable measures. In September 2024, the Singapore Exchange Regulation (SGX RegCo) finalized amendments to its Listing Rules and Sustainability Reporting Guide to integrate the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards, developed by the International Sustainability Standards Board (ISSB), into its sustainability reporting framework.

These amendments follow recommendations issued by the Sustainability Reporting Advisory Committee (SRAC) in July 2023, aimed at enhancing climate reporting for both listed and non-listed companies in Singapore. Since FY2022, listed issuers in Singapore have been required to provide climate-related disclosures aligned with the Task Force on Climate-related Financial Disclosures (TCFD). As the ISSB standards are built on the TCFD framework, listed companies are well-positioned to transition reporting ISSB-aligned climate disclosures for financial years starting on or after January 1, 2025.

For non-listed companies subject to mandatory climate reporting for the first time, the new requirements represent a more significant shift. To support this transition, these companies have been granted an additional two years to comply with the new rules. Additionally, the ISSB Standards include targeted relief measures, offering companies greater flexibility and time to implement more complex requirements.

Given that many leading organizations prioritize ESG reporting, grasping the intricate process is not a sudden revelation.

At EcoSkills, we acknowledge how challenging it is for ESG leaders to equip themselves with the right skills to make fully informed judgments because of the wide range of demands from investors and stakeholders, as well as the lack of clarity surrounding the specifics of upcoming legislation and standards.

Companies need to be aware of how to select from the available frameworks, instead of implementing them all blindly in the hopes of achieving parity.

If you are looking to fully comprehend legislative esg reporting requirements to optimize and enhance your organization’s reporting process while also improving transparency and credibility, this is a great opportunity to navigate our EcoSkills training and consulting options to ensure you have all the insights needed to highlight your organization’s commitment to ESG principles. Unlock the power of your eco-skills and embark on your ESG journey.