The ESG reporting software market stands at the cusp of remarkable expansion, poised to more than double from $0.7 billion in 2022 to approximately $1.5 billion. This substantial growth emerges from pressing business imperatives and mounting regulatory requirements that fundamentally alter corporate approaches to sustainability reporting.

Evidence of this shift manifests clearly in the numbers: ESG disclosure policies have nearly doubled from 614 in 2020 to 1,225 in 2023, underscoring the intensifying demand for transparency and accountability across industries. The landscape grows more complex with nearly 10,000 companies now preparing sustainability disclosures under the Corporate Sustainability Reporting Directive (CSRD), and even more in the following years, creating unprecedented urgency for efficient reporting mechanisms.

Corporate leadership acknowledges this pivotal change, with 87% of CEOs expressing support for integrating ESG metrics into standard corporate reporting practices. This recognition drives organizations toward specialized ESG software solutions that automate data-gathering processes, minimize manual intervention, and safeguard data integrity. These tools serve the dual purpose of maintaining regulatory compliance while generating the precise, high-quality information essential for strategic decision-making.

The selection of appropriate ESG reporting tools emerges as a critical factor for business success in 2025 and beyond, regardless of where you stand in your sustainability reporting journey. The following examination presents the top 10 solutions capable of streamlining your ESG reporting processes while delivering substantive insights that drive organizational performance and stakeholder confidence.

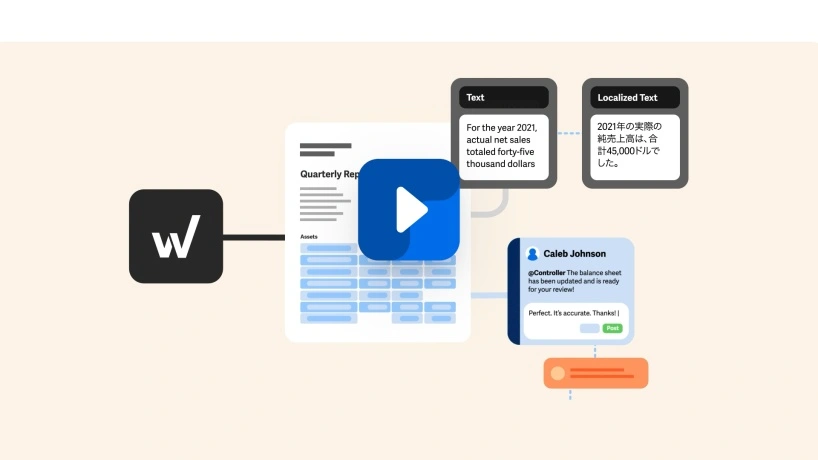

Image Source: Prophix

Prophix One positions itself as a cornerstone in the ESG reporting software landscape, offering a sophisticated Financial Performance Platform that enables finance teams to navigate complex reporting demands with precision. The platform emerges as particularly valuable amid escalating regulatory standards, providing essential tools that maintain compliance excellence without compromising operational efficiency.

The platform delivers exceptional ESG reporting capabilities through several distinctive functionalities. Prophix One brings together all your ESG data from different business systems, allowing for easy management with flexible imports, system connections, and checks for accuracy. This centralization establishes a unified truth source for reporting teams, effectively dismantling the data fragmentation that typically undermines sustainability reporting efforts.

The software harnesses in-memory technology to elevate performance metrics, enabling finance teams to process intricate plans and substantial data volumes with remarkable speed. This technological advantage proves especially beneficial when handling the extensive information sets essential for thorough ESG reporting.

For businesses navigating multiple ESG frameworks, Prophix One facilitates swift, exhaustive consolidations through intelligent automation systems. This functionality eliminates requirements for expensive customizations while safeguarding regulatory adherence. The platform further enhances disclosure management through structured authoring and approval workflows, complete with iXBRL tagging that ensures regulatory compliance.

Pros:

Cons:

Prophix One employs a subscription-based pricing structure typically extending from one to five years, with annual fees paid in advance. Several elements shape the cost structure, including contract length, user quantities, integration complexity and volume, alongside supplementary value-added services.

The platform structures pricing tiers according to user population:

Mid-market enterprises typically require licenses accommodating 15-35 users. Per-user costs fluctuate between $250 and $250,000 based on role requirements, with administrator roles demanding greater functionality commanding higher prices than read-only access. Prophix One subscriptions generally range from $15,000 to over $100,000.

Prophix One has been crafted specifically to address the requirements of the office of the CFO. The solution serves financial professionals, including CFOs, financial analysts, controllers, CIOs, and business leaders seeking to enhance their ESG reporting capabilities.

The platform particularly benefits finance teams aiming to transition from cost centers to profit optimizers by automating routine tasks and liberating time for strategic analysis. It further serves organizations requiring centralized planning capabilities that deliver real-time forecast updates with dependable data.

For enterprises confronting intricate ESG reporting requirements across multiple frameworks or regulations, Prophix One delivers the robust capabilities essential for achieving compliance while preserving operational efficiency. The platform’s capacity to process data from diverse sources makes it exceptionally valuable for businesses with varied sustainability metrics requiring tracking and reporting.

Image Source: Workiva

Trusted by over 6,300 global companies worldwide, Workiva presents a unified cloud platform that brings together financial reporting, sustainability management, and audit and risk processes within a single secure environment. This integrated approach stands in contrast to standalone solutions, enabling organizations to address the increasing demands for transparency in corporate reporting with greater efficiency and coherence.

Workiva’s platform distinguishes itself through end-to-end ESG reporting capabilities that safeguard data reliability and compliance standards. The software connects critical data from various sources into a centralized repository, establishing a single source of truth for all sustainability metrics. This interconnected methodology prevents inconsistencies when identical numbers appear in multiple locations throughout reports, maintaining data integrity across all documents.

The ESG Explorer feature represents a significant advancement, allowing users to examine multiple guidelines and frameworks simultaneously, thereby simplifying compliance with various standards. The platform further enhances efficiency through pre-built templates that align seamlessly with evolving ESG frameworks, substantially reducing time spent on report preparation.

The detailed workflow management system serves as a powerful tool for operationalizing ESG strategies through real-time collaboration. Workiva maintains a comprehensive audit trail, tracking each modification and establishing clear accountability throughout the reporting process, a critical component for organizations facing intense scrutiny from stakeholders and regulatory bodies.

Pros:

Cons:

Workiva operates on an annual licensing fee model. Although specific pricing details aren’t publicly listed, according to a Forrester study, a composite organization pays an annual licensing fee of $335,000 in the first year. This package typically includes SEC Reporting, ESG Reporting, Internal Audit Management solutions, plus professional services support. No setup fees are required to begin implementation.

Workiva delivers exceptional value for organizations managing complex reporting requirements across multiple frameworks and jurisdictions. The platform has demonstrated particular benefits for companies with agriculture-based supply chains, such as The Hershey Company, which employs Workiva to streamline ESG management across operations spanning global communities.

The solution proves most effective in environments where reporting involves numerous contributors—The Hershey Company’s sustainability report, for instance, incorporates input from over 100 subject matter experts covering more than 800 metrics. Organizations preparing for regulatory changes like the Corporate Sustainability Reporting Directive (CSRD) will find significant advantages in Workiva’s capacity to handle double materiality assessments and manage compliance with approximately 750 disclosure requirements.

Image Source: IBM

IDC MarketScape positions IBM Envizi ESG Suite as a leader in carbon accounting, offering a sophisticated platform that enhances sustainability data management and reporting processes. This modular solution captures, transforms, and unifies disparate ESG data to establish a centralized information repository while yielding practical insights that drive decarbonization initiatives.

IBM Envizi ESG Suite demonstrates exceptional prowess in handling intricate sustainability data through its multifaceted capabilities. The platform automatically gathers and consolidates information from hundreds of data types across fragmented sources into a cohesive system of record. This comprehensive approach incorporates file-loading connectors, purpose-built API integrations, and structured manual data entry pathways with integrated workflow tools.

The suite extends beyond mere data collection to deliver robust greenhouse gas emissions accounting functionality. Users can execute detailed Scope 1, 2, and 3 carbon emissions calculations through an AI-driven engine founded on GHG Protocol principles. The platform’s AI assistant for Scope 3 data categorization stands as a particularly valuable asset, with one client documenting a 45% reduction in error rates.

For reporting, the system allows answers to different ESG frameworks from one data source, including built-in framework questions and careful datag. Its adaptability supports customized reporting structures across locations, portfolios, and cost centers.

The platform further enhances decarbonization planning through sophisticated analytics and AI-enhanced forecasting tools that support emissions reduction initiatives and monitor performance against established commitments.

Pros:

Cons:

IBM Envizi presents three distinct package options to address varying organizational requirements:

The Essentials package serves organizations collecting sustainability data for the first time. It features predetermined pricing for specific functionality, including Scope 1, 2, and 3 GHG accounting capabilities with an integrated emissions calculation engine.

The Standard package introduces variable pricing based on particular requirements, offering enhanced flexibility compared to the Essentials tier.

For enterprises requiring maximum customization, the Premium package delivers complete flexibility to expand functionality and scale the solution according to evolving needs.

IBM offers a 14-day trial of the Envizi Essentials package at no cost, without credit card requirements.

IBM Envizi ESG Suite delivers exceptional value for large, complex organizations seeking to harness data and analytics to achieve sustainability objectives. The platform serves companies needing to establish robust data foundations for ESG reporting while enhancing disclosure processes.

Organizations managing global operations or navigating structural changes find particular benefit in the solution, as it accommodates varied reporting structures to address diverse stakeholder requirements. Companies with extensive data collection needs will appreciate Envizi’s capacity to process over 15,000 unique data types, as demonstrated by Ikano Group’s implementation for CSRD reporting.

The platform’s capability to identify efficient, cost-effective pathways to low-carbon operations makes it an ideal choice for businesses accelerating decarbonization initiatives.

Image Source: Workday

Workday Adaptive Planning emerges as a pivotal solution for companies seeking ESG functionality already embedded within their financial systems. The platform delivers comprehensive sustainability reporting capabilities without the need for separate tools. This unified approach connects emissions data directly to financial planning, creating an integrated sustainability management framework for forward-thinking organizations.

The platform excels in sustainability data management through several distinctive capabilities. Workday enables real-time conversion of energy consumption data into CO2 equivalents using automated conversion factors, significantly simplifying otherwise complex carbon accounting procedures. This functionality spans Scope 1, 2, and 3 emissions tracking, offering complete visibility across the entire carbon footprint.

A particularly noteworthy feature involves the integration of emissions planning directly into financial planning sheets. This strategic connection allows finance teams to measure climate risk impacts on business operations while simultaneously developing carbon reduction strategies. The result transforms sustainability from an isolated annual exercise into an integral component of monthly reporting cycles.

Workday further enhances ESG management through its robust scenario modeling capabilities. These tools enable organizations to evaluate potential risks, identify opportunities, and visualize the impacts of various strategic decisions while maintaining alignment with sustainability objectives. Finance teams can model carbon footprint scenarios alongside their corresponding financial implications, creating a holistic view of business performance.

Pros:

Cons:

Workday provides a free 30-day trial featuring guided walkthroughs of core planning capabilities alongside step-by-step guides for planning, reporting, and dashboards. Following this trial period, the company offers two subscription options.

The Workday Adaptive Planning subscription connects with any ERP or GL system while offering unlimited versions and what-if scenarios. The Workday Adaptive Planning & Consolidation package builds upon the base subscription, adding close and consolidation capabilities.

Despite offering clearly defined packages, Workday does not publicly disclose specific pricing information on their website, instead tailoring costs to individual business requirements.

Workday Adaptive Planning proves particularly suitable for large financial teams operating in enterprise environments. The platform delivers exceptional value to organizations needing to demonstrate tangible progress toward net-zero emissions targets through systematic planning and measurement.

The solution performs exceptionally well for companies with complex multi-entity structures or sophisticated financial consolidation requirements. Notable enterprise users include Boston Scientific, MLB, Hitachi, and Dril-Quip.

Organizations seeking to establish connections between emissions data and financial insights will find Workday’s integrated approach particularly valuable. The platform enables sustainability managers to calculate emissions from diverse sources, including employee commutes and supply chain activities. This comprehensive perspective supports critical business decisions while advancing corporate sustainability objectives.

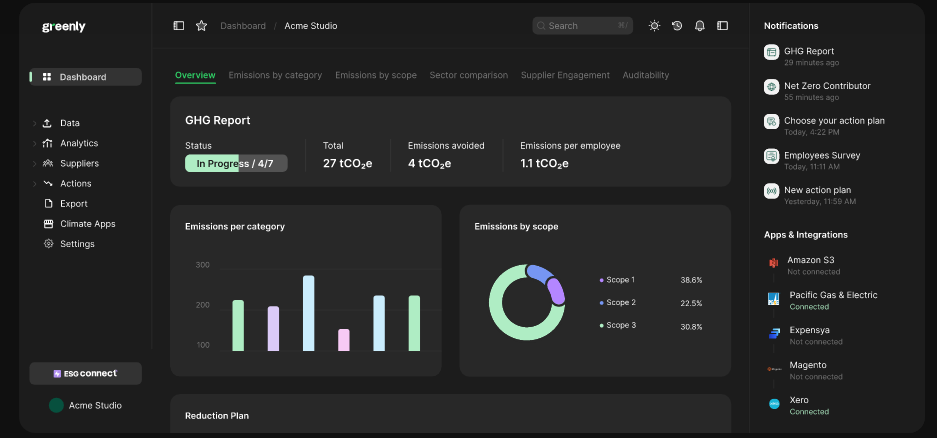

Image Source: Greenly

Greenly stands as a prominent fixture in the ESG reporting landscape, with over 3,500 businesses entrusting their carbon management to its comprehensive platform. The software offers a complete solution for organizations to track, reduce, and report environmental impact through streamlined data collection processes and analytics verified by industry experts.

The Greenly platform distinguishes itself through exceptional sustainability management capabilities. The system’s AI-powered anomaly detection identifies statistical inconsistencies within environmental data, resulting in approximately 80% time savings compared to traditional manual verification methods. Users gain access to an extensive library exceeding 150,000 emission factors, which includes 40,000 monetary emission factors and 30,000 customized supplier-specific factors, ensuring calculation precision and reliability.

Greenly extends beyond basic carbon accounting to offer multi-criteria lifecycle assessments fully aligned with established frameworks such as CBAM and EPD. Organizations achieve enhanced Scope 3 accuracy through dedicated supplier engagement tools that simultaneously support CSDDD compliance requirements.

The platform equips sustainability teams with detailed, quantified decarbonization strategies that adhere to Science-Based Targets Initiative (SBTi) standards. Reports generated within the system maintain compliance with numerous reporting frameworks, including CDP, CBAM, EPD, SASB, and ISSB.

Pros:

Cons:

Greenly presents three distinct annual subscription tiers for carbon assessment services:

Each price covers a 12-month subscription for one carbon assessment/entity, with potential discounts available for multi-entity businesses. All packages include online support, with higher tiers offering enhanced features such as dedicated onboarding assistance and project management resources.

Greenly serves organizations throughout every phase of their sustainability journey, regardless of industry classification or organizational size. The platform delivers particular value to companies establishing accurate baseline measurements across all emission scopes while developing practical, implementable reduction strategies.

Organizations facing compliance requirements with complex sustainability standards find significant value in Greenly’s framework-aligned reporting capabilities. Companies focusing on supply chain emissions management benefit from the supplier commitment solution and extensive database of sustainable suppliers.

The platform proves most effective for organizations seeking to embed sustainability principles into their core operational practices through accessible tools and expert guidance, moving beyond mere compliance-focused ESG reporting to create meaningful environmental impact.

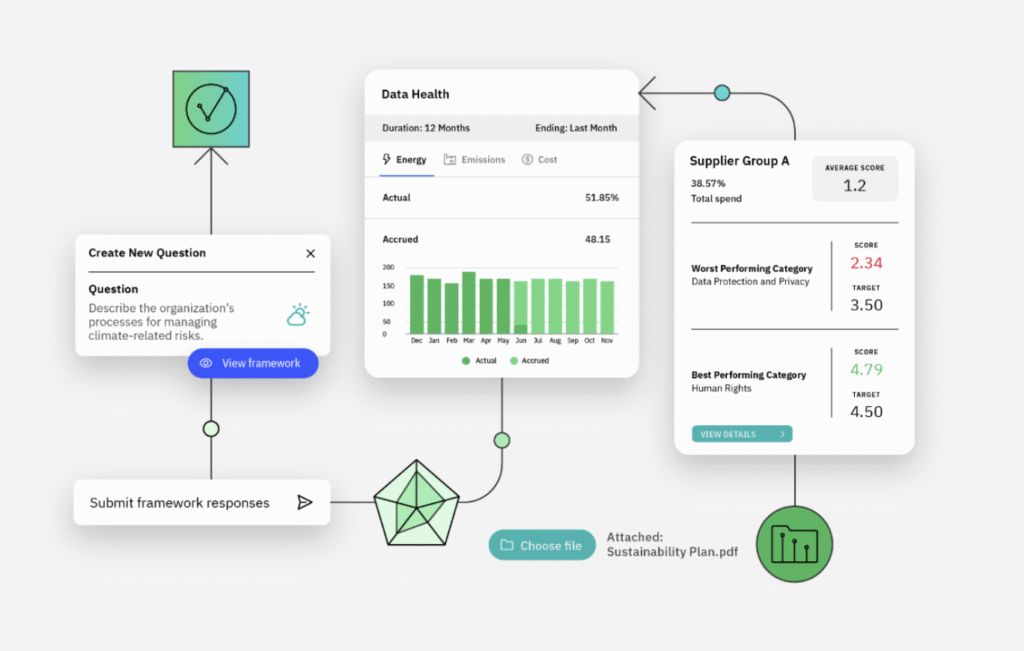

Image Source: Novata

Novata emerges as a specialized platform crafted specifically for private markets, offering a secure and intuitive ESG reporting solution that fundamentally simplifies sustainability data management for private equity firms and their portfolio companies. This independent intermediary stands as a guide for organizations navigating the increasingly complex ESG landscape through accessible tools and expert guidance.

The framework builder tool from Novata establishes a clear pathway for organizations beginning their ESG journey, tailoring the approach based on specific company requirements. At the core of the platform resides an extensive metric library housing over 1,100 metrics [link_27], each thoughtfully mapped to global standards and frameworks while featuring built-in difficulty ratings that indicate collection complexity. These metrics come equipped with in-platform guidance materials, practical calculators, and AI-powered guardrails designed to streamline and simplify the data submission process.

For analytical purposes, Novata delivers powerful visualization tools that convert raw sustainability data into strategic insights. The platform hosts what many consider the most comprehensive collection of private markets’ ESG benchmarks available today—featuring 350 sector-specific benchmarks alongside 75 universal benchmarks. Beyond these analytical strengths, Novata maintains rigorous security standards through ISO 27001 certification and SOC2 Type II compliance across multiple trust principles including security, confidentiality, and availability.

Pros:

Cons:

Novata does not openly share pricing details for its ESG reporting platform. The company appears to implement tailored pricing structures determined by individual client requirements and scope. Interested organizations can submit requests for customized quotations directly through the Novata website.

Novata primarily addresses the needs of private market participants, making it particularly suitable for private equity firms, private credit providers, and venture capital companies seeking robust sustainability reporting solutions. The platform delivers exceptional value to organizations across various ESG maturity stages looking to enhance and formalize their sustainability programs.

We see particular benefits for ESG newcomers requiring structured guidance on sustainability assessments and metric selection. The platform’s easy-to-understand metric explanations and teamwork features make it perfect for companies starting formal ESG reporting while getting ready to meet growing demands from stakeholders about sustainability performance and transparency.

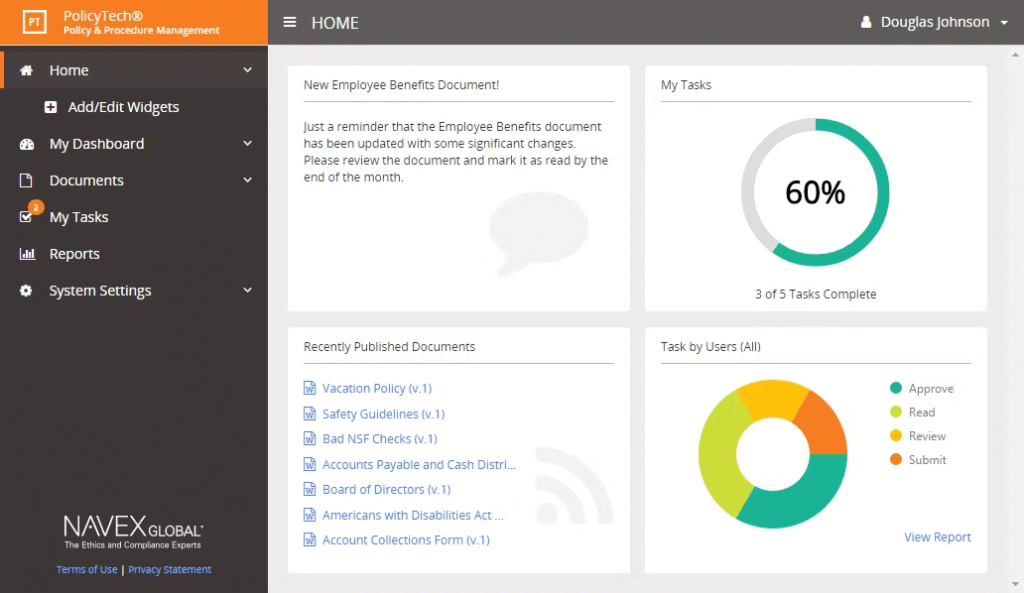

Image Source: NAVEX

NAVEX One stands as a unifying force in ESG management, consolidating disparate sustainability information into a single, authoritative platform. Serving over 13,000 organizations worldwide, including industry leaders such as PepsiCo, Cargill, and Diageo, this solution fundamentally reshapes corporate approaches to sustainability through its integrated governance, risk, and compliance framework.

The platform delivers a panoramic view of organizational risk through an intuitive interface that seamlessly integrates ESG metrics with broader compliance data. This all-in-one method allows for accurate monitoring of important sustainability factors—like carbon emissions, progress on disclosures, and risks from suppliers—available in one easy-to-use dashboard.

NAVEX One excels in natural resource impact management through automated calculations of greenhouse gas footprints and systematic performance monitoring against established targets. The solution further enhances operational efficiency through collaborative reporting workflows that both conserve valuable time and establish a cohesive representation of ESG progress.

For organizations focused on responsible supply chain practices, the platform facilitates third-party assessment of sustainability initiatives while providing valuable benchmarking capabilities against broader supplier networks. This functionality extends to supplier data integration for managing responsible sourcing of conflict minerals and ensuring adherence to Dodd-Frank compliance requirements.

Pros:

Cons:

The solution begins at $150,000 per month with adjustable pricing structures based on specific implementation requirements. Pricing variables include organizational scale and functional needs, with a foundational plan available for standard implementations. Comprehensive enterprise pricing details require direct consultation with NAVEX representatives.

NAVEX One proves particularly valuable for organizations pursuing consolidated approaches to governance, risk, and compliance management. The platform serves companies navigating intricate regulatory landscapes where ESG considerations demand equivalent attention to other business risks.

Global shipping and logistics enterprises like DP World illustrate the platform’s practical application through streamlined incident reporting and case management across varied operational contexts and languages. The solution ultimately benefits any organization seeking to embed ESG principles within core business operations while maintaining comprehensive visibility of risk factors across the enterprise.

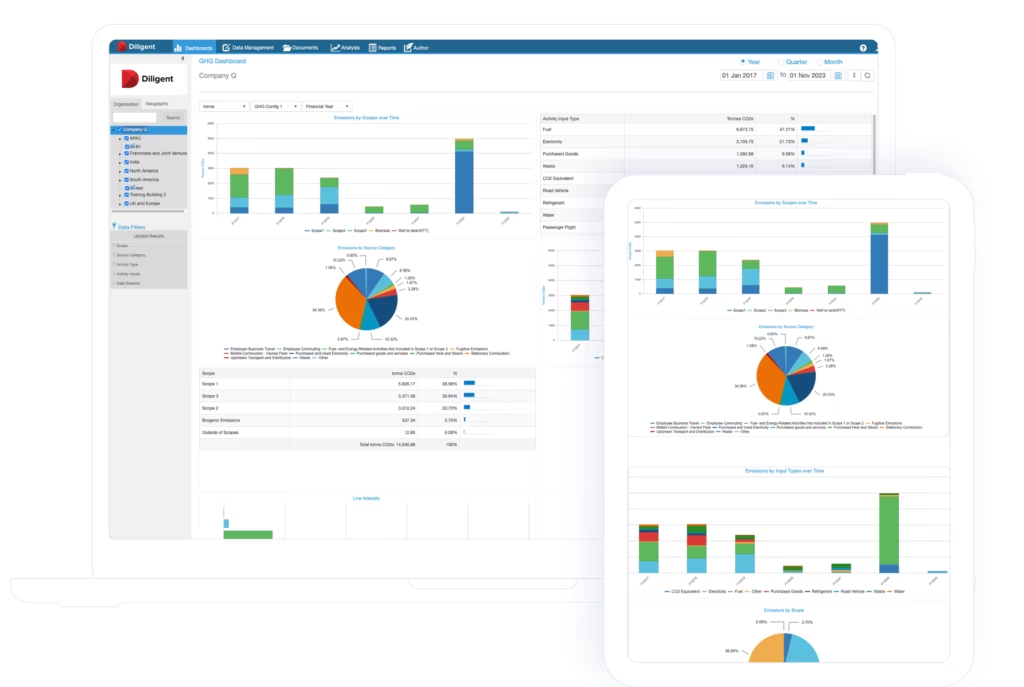

Image Source: Diligent

Diligent ESG stands as a distinguished platform for organizations aiming to enhance their sustainability reporting processes. This tailored solution simplifies intricate ESG data management while delivering concrete ROI-focused advantages, rendering sustainability governance more attainable for companies at different phases of their ESG maturity.

Diligent ESG unifies all sustainability information within a single platform, successfully eliminating reporting inconsistencies and omissions. The system aligns ESG data against perpetually refreshed standards, including SASB, GRI, TCFD, WEF, and CDP, alongside your proprietary internal frameworks. One of its key features is the use of robotic process automation designed to help gather and analyze ESG data.

The platform streamlines information gathering through intelligent workflows that distribute responsibilities, issue questionnaires, generate reminders, and monitor advancement toward established objectives. Particularly remarkable are the immediate greenhouse gas computations derived from more than 70,000 automatically updated emissions factors. For carbon disclosure purposes, the system generates up to 80 distinct, pre-formatted, audit-ready reports.

Pros:

Cons:

Diligent presents three 12-month contractual arrangements tailored to varying organizational requirements:

Each successive tier expands upon the previous level with supplementary capabilities for more sophisticated ESG reporting demands.

Diligent ESG proves most suitable for medium to large enterprises with established ESG reporting functions. The platform particularly serves organizations requiring thorough coverage across emission scopes, corporate social responsibility metrics, and supply chain information sources.

Through its immediate activity-based measurement functionalities, Diligent accommodates companies needing submission-ready reports that withstand auditor scrutiny. The solution has demonstrated exceptional value for businesses seeking to bolster investor trust and market standing through refined ESG reporting quality. Fundamentally, organizations aiming to demonstrate tangible returns on their sustainability technology investments find Diligent’s documented financial benefits persuasive.

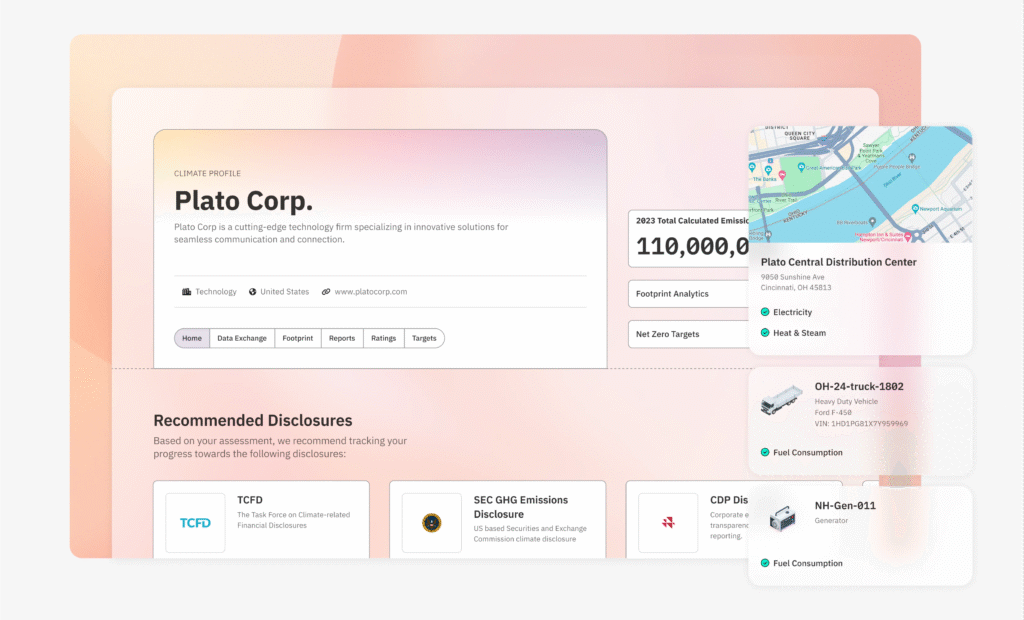

Image Source: www.persefoni.com

Persefoni, aptly named the “ERP of Carbon,” stands as a distinguished Climate Management & Accounting Platform (CMAP) that enables corporations, financial institutions, and government agencies to manage carbon data with the same rigor and precision traditionally reserved for financial transactions.

The platform’s architecture reflects a profound understanding of carbon accounting nuances. Persefoni skillfully translates the complex Greenhouse Gas Protocol into accessible business language, making sustainability reporting approachable for executives who may lack familiarity with intricate environmental standards. The strategic partnership with Workiva yields significant reporting efficiencies—with 75% of U.S. companies already utilizing Workiva for SEC reporting, the integration of climate data becomes remarkably straightforward.

At the core of Persefoni’s offering lies the auditable Footprint Activity Ledger, serving as an authoritative carbon data repository across organizational structures. The platform harnesses sophisticated AI capabilities, including proprietary GPT models that substantially enhance data accuracy and reliability. Users benefit from instantaneous greenhouse gas calculations powered by more than 70,000 automatically updated emissions factors, ensuring reporting precision.

Pros:

Cons:

Persefoni has introduced a free version, Persefoni Pro, specifically designed to help businesses measure and disclose greenhouse gas emissions without initial financial commitment. For organizations requiring more advanced functionality, the company offers subscription-based pricing structures with details available upon direct inquiry.

The platform demonstrates particular value for organizations requiring advanced capabilities for managing sustainability. The solution specifically serves

Persefoni delivers exceptional value for organizations needing to convert activity data into operational or financed emissions calculations while maintaining audit-ready reporting standards that withstand rigorous scrutiny.

The comparison below gives a clear look at top ESG reporting platforms, helping you make smart choices based on their main features, benefits, drawbacks, costs, and best uses. A systematic evaluation highlights distinctive attributes across solutions while facilitating identification of the most suitable option for specific organizational requirements and sustainability objectives.

| Software Solution | Key Features | Main Pros | Main Cons | Pricing | Best Suited For |

|---|---|---|---|---|---|

| Prophix One | – Centralized ESG data repository – In-memory technology – Intelligent automation – iXBRL tagging | – Centralized data management – Automation features – Interactive dashboards – Pre-built connectors | – Time investment needed – Depends on input data quality – Limited dashboard formatting | $15,000 to $100,000+ Based on user tiers | Office of the CFO, financial professionals, organizations with complex ESG reporting requirements |

| Workiva | – End-to-end ESG reporting – ESG Explorer tool – Pre-built templates – Real-time collaboration | – Automatic number linking – Full auditability – Streamlined collaboration – Reduces audit time | – Learning curve for tagging – Customer support challenges – Performance issues | $335,000 annual licensing fee (first year) | Organizations with complex reporting requirements and multiple frameworks |

| IBM Envizi ESG Suite | – Automated data capture – GHG emissions accounting – AI-driven forecasting – Framework-aligned reporting | – Single authoritative system – Automatic data normalization – Enhanced data quality – Comprehensive audit trail | – Higher cost structure – High-end hardware required – System stability issues | Three tiers: – Essentials – Standard – Premium (Specific pricing not disclosed) | Large, complex organizations with global operations |

| Workday Adaptive Planning | – Real-time emissions conversion – Integrated financial planning – Scenario modeling – Carbon footprint tracking | – Built-in ESG solutions – ERP integration – Unlimited scenarios – Collaborative functionality | – Difficult customization – Poor report formatting – Complex formula syntax – Steep learning curve | Not publicly disclosed; Subscription-based pricing | Large financial teams in enterprise environments, organizations with net-zero targets |

| Greenly | – AI-powered anomaly detection – 150,000+ emission factors – Multi-criteria assessments – Supplier engagement tools | – Intuitive interface – System integration – Detailed dashboards – Expert-led support | – Significant initial investment – Data quality dependent – Higher pricing points | Annual tiers: – Basic: $3,800 – Standard: $5,800 – Premium: $7,800 | Organizations at any stage of sustainability journey, companies focusing on supply chain emissions |

| Novata | – Framework builder tool – 1,100+ metrics library – AI-powered guardrails – Comprehensive benchmarks | – Private market focus – User-friendly interface – Customizable experience – Multi-user collaboration | – Not intuitive for new users – Features under development – Vague customer support | Not publicly disclosed | Private market participants, PE firms, VC companies |

| NAVEX One | – Unified risk platform – Automated calculations – Supplier assessment – Collaborative workflows | – Comprehensive risk view – Shared services – Framework alignment – Audit-ready reporting | – Document organization issues – High cost – Complex interface | Starts at $150,000 per month | Organizations managing complex regulatory environments |

| MSCI ESG Manager | – ESG IVA Ratings – ESG Impact Monitor – Business Involvement Screening – ESG Alert functionality | – Enhanced risk insights – Simplified reporting – Comprehensive ratings – Efficient screening | – GHG emissions undervaluation – Confusing rating scale – Higher fees – Limited customization | Not publicly disclosed | Investment community, asset managers, academic institutions |

| Diligent ESG | – Centralized data platform – Automated workflows – 70,000+ emissions factors – Pre-configured reports | – 167% ROI – 50% reduced audit costs – Time savings 60-80% – Enhanced investor trust | – Steep learning curve – Limited customization – Data accuracy dependent | Annual tiers: – Essentials: $33,000 – Pro: $66,750 – Pro Plus: $87,500 | Medium to large companies with dedicated ESG teams |

| Persefoni | – Climate Management Platform – Footprint Activity Ledger – AI capabilities – GHG Protocol translation | – Strong carbon accounting – Expert-backed – AI-driven technology – High customer satisfaction | – Challenging setup – Integration difficulties – Confusing templates | Free version available; Premium pricing not disclosed | Financial services, PE/VC firms, insurance companies, corporations |

ESG reporting now stands as a fundamental business function rather than merely a compliance exercise. The examination of leading ESG reporting software tools reveals distinct patterns that illustrate how these platforms address expanding regulatory requirements while simultaneously delivering strategic advantages to organizations.

Each solution presents distinctive methods for centralizing sustainability data, automating intricate calculations, and ensuring alignment with evolving frameworks and standards. This diversity enables organizations to select tools specifically tailored to their industry context, organizational scale, and ESG maturity. Financial departments gain particular benefits from platforms like Prophix One and Workday Adaptive Planning, while investment specialists may find MSCI ESG Manager more aligned with their specific requirements.

The value proposition of these tools extends far beyond baseline compliance. They provide crucial insights that directly connect sustainability metrics with financial outcomes and operational performance. This integration enables organizations to elevate ESG reporting from a cost-generating obligation to a strategic asset. The capabilities to model various scenarios, measure progress against established targets, and conduct peer benchmarking ultimately foster more informed decision-making throughout the enterprise.

One certainty emerges regardless of which solution an organization adopts: companies investing in robust ESG reporting infrastructure secure meaningful advantages in transparency, operational effectiveness, and stakeholder confidence. These benefits will only intensify as regulatory frameworks continue to expand and stakeholder expectations for accountability increase across global markets.

The journey toward effective ESG reporting demands careful assessment of specific organizational needs, resource availability, and long-term sustainability objectives. The ideal software partnership transcends mere compliance facilitation—it fundamentally enhances an organization’s approach to corporate responsibility and sustainable business practices through 2025 and beyond.

Q1. What are the key features to look for in ESG reporting software? The most important features include centralized data management, automated calculations, alignment with reporting frameworks, real-time collaboration capabilities, and robust analytics tools. Look for solutions that offer customizable dashboards, audit trails, and integration with existing business systems.

Q2. How can ESG reporting software benefit my organization? ESG reporting software can streamline data collection, reduce manual errors, save time on report creation, and provide actionable insights. It helps organizations track progress on sustainability goals, comply with regulations, and make data-driven decisions to improve ESG performance and stakeholder communication.

Q3. What is the typical cost range for ESG reporting software? Pricing varies widely based on company size and needs. Basic solutions may start around $3,000–$5,000 annually, while enterprise-level platforms can cost over $100,000 per year. Many vendors offer tiered pricing models, with some providing free versions for smaller organizations just starting their ESG journey.

Q4. Which industries benefit most from using ESG reporting software? While ESG reporting is relevant across various sectors, industries that face stringent regulations or have a high environmental impact particularly benefit from it, such as financial services, energy, manufacturing, and consumer goods. However, companies of all types and sizes can leverage these tools to improve sustainability management and reporting.

Q5. How does AI enhance ESG reporting software capabilities? AI in ESG software can automate data collection, detect anomalies, improve accuracy in emissions calculations, and provide predictive analytics. It helps in scenario modeling, identifying sustainability risks and opportunities, and generating more insightful reports. Some platforms use AI to simplify complex ESG frameworks and enhance user experience.