The Sustainability Accounting Standards Board (SASB) is a nonprofit organization dedicated to developing and maintaining standards for sustainability reporting. Established in 2011, SASB addresses the need for a consistent and standardized approach to reporting on environmental, social, and governance (ESG) issues that have the potential to impact a company’s financial performance. By providing a structured framework, SASB enables businesses and investors to effectively communicate and understand sustainability-related risks and opportunities that are relevant to business value and long-term operational success.

As is the case with other existing standards, the primary goal of SASB is to create a common language for sustainability reporting, ensuring that disclosures are relevant, comparable, and useful for investors. SASB Standards are industry-specific, covering 77 different sectors, each with its unique set of sustainability challenges and opportunities. This specificity allows companies to report on the most pertinent issues that could influence their financial outcomes, making the information highly valuable for investors who need to make informed decisions.

SASB Standards are designed with a focus on “financial materiality,” emphasizing sustainability factors that can significantly impact a company’s financial performance. This focus sets SASB apart from other sustainability reporting frameworks, such as the Global Reporting Initiative (GRI), which also considers broader social and environmental impacts. SASB’s approach ensures that the information provided is directly relevant to investors and other stakeholders concerned with financial outcomes. Here are the key components that make SASB Standards effective:

Industry-Specific Standards: SASB offers tailored standards for 77 distinct industries, each addressing unique sustainability challenges and opportunities relevant to that sector. This industry-specific approach ensures that the reported data is pertinent and valuable to stakeholders. For example, the sustainability concerns for a healthcare company—such as patient privacy and data security—differ from those of an oil and gas company, which might focus more on emissions and resource management.

By customizing standards to fit each industry, SASB ensures that companies report on the most critical issues affecting their financial performance.

Materiality: A core feature embedded in SASB Standards is the emphasis on materiality. The SASB Materiality Map identifies and visualizes the sustainability issues most likely to affect financial performance within each industry. This tool helps companies and investors concentrate on the factors that matter most, ensuring that the sustainability disclosures are not only all-encompassing but also strategically significant. This focus on materiality ensures that the reporting is both relevant and useful, providing insights that can drive informed decision-making.

Investor Focus: SASB Standards are specifically designed to meet the informational needs of investors. By highlighting sustainability issues that can impact a company’s ability to create long-term value, SASB helps investors understand and evaluate these factors in their investment decisions. The standards facilitate the comparison of sustainability performance across companies and industries, helping investors manage risks and identify opportunities. This investor-centric approach makes SASB Standards a critical tool for aligning corporate sustainability efforts with financial performance and market expectations.

By focusing on these key components, SASB Standards provide a clean-cut framework for sustainability reporting that is aligned with the financial interests of investors. This alignment helps companies communicate their sustainability efforts more effectively and supports the integration of sustainability considerations into business strategy and investment decisions.

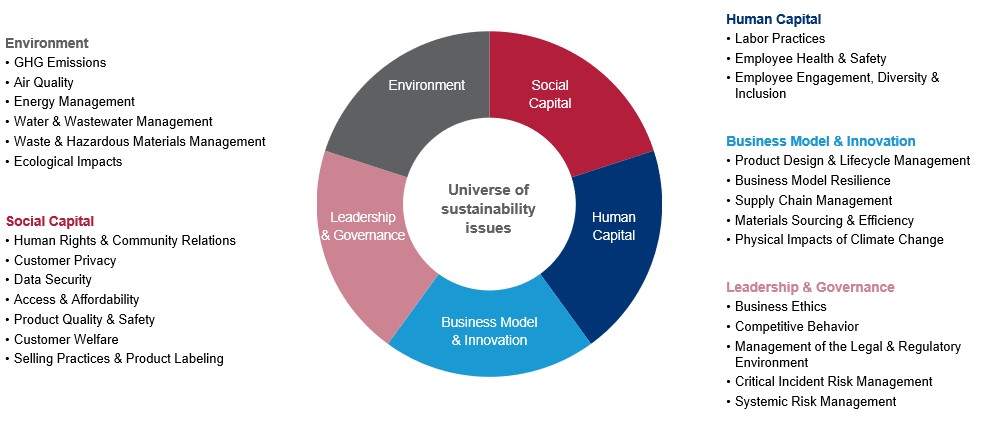

SASB categorizes sustainability issues into five key dimensions that help companies focus on the most relevant factors affecting long-term value creation:

Image Source: https://sasb.ifrs.org/implementation-primer/

As illustrated above, these five dimensions ensure that SASB Standards fully address the critical areas impacting a company’s ability to create long-term shareholder value.

One of the foremost benefits of adopting SASB Standards is the enhancement of transparency. These standards provide a clear and consistent framework for disclosing sustainability-related information, ensuring that companies communicate their ESG practices in a straightforward manner. This transparency builds trust and credibility among investors and other stakeholders by allowing them to see how a company is addressing key sustainability issues. Clear, transparent reporting also helps mitigate information asymmetry between companies and their stakeholders, facilitating better understanding and trust.

Another prominent benefit is that SASB Standards enable companies to engage more effectively with a broad range of stakeholders. By addressing key sustainability issues in a standardized format, companies can ensure that their reporting meets the informational needs of various groups, including investors, customers, employees, and regulators. This standardized approach not only improves communication but also demonstrates a company’s commitment to addressing stakeholder concerns. Effective stakeholder engagement is crucial for building long-term relationships and gaining support for sustainability initiatives.

Moreover, detailed insights provided by SASB reporting allow companies to make more informed decisions. By identifying and analyzing sustainability risks and opportunities, companies can allocate resources more effectively, prioritize initiatives that offer the greatest benefits, and manage risks more efficiently. For investors, SASB disclosures provide critical information that extends beyond traditional financial metrics, helping them assess a company’s long-term viability and sustainability performance. This complete understanding supports better investment decisions and improves overall strategic planning.

On another front, SASB Standards facilitate proactive risk management by requiring companies to identify and disclose sustainability risks. This forward-looking approach helps companies anticipate potential challenges and implement strategies to mitigate negative impacts. Effective risk management is essential for maintaining business continuity and resilience, particularly in an increasingly complex and interconnected global environment. By addressing risks early, companies can avoid costly disruptions and enhance their ability to adapt to changing conditions.

It has also been established that adopting SASB Standards can provide companies with a competitive edge. By showcasing their commitment to transparency and sustainability, companies can differentiate themselves from peers and attract investors, customers, and employees who prioritize corporate responsibility. Demonstrating solid sustainability practices can enhance a company’s reputation, drive customer loyalty, and improve employee engagement and retention. Additionally, companies that effectively manage sustainability risks and opportunities are better positioned to succeed in a market that increasingly values ethical and sustainable practices.

SASB encourages a culture of continuous improvement by requiring companies to regularly monitor and update their sustainability disclosures. This ongoing process allows companies to track their progress, identify areas for improvement, and adjust their strategies as needed. Continuous improvement not only enhances sustainability performance but also demonstrates a company’s commitment to evolving and responding to new challenges and opportunities. This adaptability is crucial for long-term success and resilience in a rapidly changing world.

The SASB reporting process begins with thorough preparation. Companies need to identify the relevant SASB Standards for their industry and gain a deep understanding of the specific sustainability issues they must address. This step involves researching the industry standards, gathering relevant documents, and setting up the internal processes required for effective reporting.

Conducting a materiality assessment is a critical step in the SASB reporting process. This assessment helps companies determine which sustainability issues are most significant to their financial performance and stakeholder interests. By prioritizing the most relevant topics, companies can ensure that their reports focus on the areas that matter most, providing valuable insights to investors and other stakeholders.

Accurate data collection is paramount for reliable reporting. Companies need to gather comprehensive data on the identified sustainability issues from both internal sources (such as operational metrics and employee surveys) and external sources (such as industry benchmarks and stakeholder feedback). This data forms the foundation of the sustainability report and must be collected meticulously to ensure accuracy and completeness.

By following these steps, companies can effectively implement SASB Standards and produce high-quality sustainability reports that provide valuable insights to investors and other stakeholders. This structured approach supports transparency, accountability, and continuous improvement in corporate sustainability practices.

Difference Between GRI and SASB Reporting

The Global Reporting Initiative (GRI) and the SASB serve distinct but complementary purposes in the realm of sustainability reporting. While SASB focuses specifically on “financial materiality,” emphasizing the sustainability factors that can impact a company’s financial performance, GRI Standards address broader impacts on the economy, environment, and society, known as “impact materiality.”

GRI aims to provide an in-depth view of a company’s sustainability impact, which includes economic, environmental, and social dimensions. This broader scope makes GRI particularly useful for stakeholders who are interested in understanding a company’s overall contributions to sustainable development, beyond just financial performance. For example, GRI standards might cover how a company’s operations affect local communities, biodiversity, and human rights.

By using both GRI and SASB frameworks, companies can offer a more comprehensive picture of their sustainability performance. This dual approach allows them to meet the informational needs of a wide range of stakeholders, from investors looking for financially material information to broader audiences interested in the company’s overall sustainability impact.

Difference Between TCFD and SASB

The Task Force on Climate-Related Financial Disclosures (TCFD) and SASB Standards are both critical tools for sustainability reporting, but they serve different functions. TCFD provides guidelines specifically for reporting on climate-related financial risks, helping companies disclose how climate change affects their governance, strategy, risk management, and metrics.

TCFD’s focus is narrowly on climate-related issues, making it an essential framework for companies in industries heavily impacted by climate change, such as energy, transportation, and agriculture. It helps companies and investors understand the financial implications of climate-related risks and opportunities, facilitating more informed decision-making and strategic planning in response to climate change.

Using both TCFD and SASB together can provide a comprehensive view of a company’s sustainability risks and opportunities, with TCFD focusing on climate-specific disclosures and SASB covering a wider array of financially material ESG issues.

At EcoSkills, we emphasize the importance of transparent and effective sustainability reporting. By adopting SASB Standards, organizations can align their sustainability efforts with globally recognized best practices, enhancing their impact and credibility. For more insights on sustainability, explore our EcoSkills blog and learn how you can contribute to a greener future.

Here are some specific EcoSkills articles that relate to SASB Standards and sustainability reporting:

SASB Standards provide a structured approach for sustainability reporting, helping organizations disclose material sustainability information that is critical for investors. By integrating these standards into their reporting practices, companies can improve transparency, manage risks more effectively, and achieve better sustainability outcomes.