The United Kingdom, along with the EU, has some of the world’s most advanced and complex sustainability reporting standards that are reshaping corporate transparency. As your organization prepares for upcoming regulatory changes, understanding these evolving requirements will be crucial for compliance and strategic planning.

The UK Sustainability Reporting Standards (UK SRS) will serve as the foundation for this comprehensive reporting framework. They are designed to enhance corporate transparency and accountability, further aligning with global sustainability frameworks, such as those developed by the International Sustainability Standards Board (ISSB). The UK Sustainability Reporting Standards wants to create a consistent way for businesses to share information about their environmental impact, following the guidelines from IFRS S1 and IFRS S2.

Official, complete UK SRS standards, with consultations on the draft standards, have begun in the first quarter of 2025, and implementation is scheduled no earlier than January 2026. Additionally, the UK Sustainability Disclosure Technical Advisory Committee has recommended prioritizing interoperability between ISSB standards and the European Sustainability Reporting Standards, addressing a critical concern for UK businesses with close trade and regulatory ties to the EU.

Image Source: Info-Tech Research Group

The UK Sustainability Reporting Standards represent a significant evolution in corporate environmental reporting across the United Kingdom. Established through a rigorous consultation and endorsement process, these standards are poised to reshape how businesses communicate their sustainability performance.

The UK Sustainability Reporting Standards is a set of guidelines designed to standardize sustainability reporting for businesses operating in the UK. Their purpose is to enhance corporate transparency and accountability by ensuring companies disclose their environmental, social, and governance (ESG) performance in a consistent and comparable manner. Primarily designed to provide investors with decision-useful information, the UK SRS enables better assessment of sustainability-related risks and opportunities that could affect an entity’s financial position in the short, medium, and long term. The standards focus on financial materiality, requiring companies to report on sustainability factors that impact business operations and financial performance.

The UK government has been a strong supporter of the International Sustainability Standards Board (ISSB) since its launch at COP26 in 2021. Consequently, the UK SRS will be based on the ISSB’s IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures) standards published in June 2023. The UK government is currently consulting on exposure drafts of UK SRS S1 and UK SRS S2, which include six minor amendments to the original ISSB standards deemed necessary for the UK context. In December 2024, the Technical Advisory Committee (TAC) presented its final recommendations, advocating for the endorsement of both IFRS standards with minimal modifications.

The UK SRS creates an independent corporate sustainability reporting regime, while the European Union’s Corporate Sustainability Reporting Directive (CSRD) does not apply directly in the UK. Notable differences include:

This alignment with global standards while acknowledging UK-specific needs positions the UK SRS as a critical tool for businesses navigating evolving sustainability reporting requirements.

As UK businesses prepare for new environmental compliance mandates, understanding the specific requirements of the UK Sustainability Reporting Standards (UK SRS) becomes critical. These standards introduce significant changes to corporate reporting practices starting in 2025.

The UK SRS establishes a phased implementation approach for greenhouse gas emissions reporting:

This graduated timeline gives businesses time to adapt, particularly regarding the complex task of measuring Scope 3 emissions throughout supply chains. Importantly, financial institutions must also calculate financed emissions; however, the UK government has acknowledged that there are implementation challenges related to timing and methodology.

Companies must report on their governance structures for managing climate risks, aligned with the four pillars established by the Task Force on Climate-related Financial Disclosures (TCFD): governance, strategy, risk management, and metrics and targets. Accordingly, organizations must disclose board oversight of climate issues and describe their climate-related risk management processes, including scenario analysis to test business resilience.

The UK SRS builds upon existing frameworks, including Streamlined Energy and Carbon Reporting (SECR) and TCFD requirements. However, UK SRS expands significantly beyond SECR’s focus on energy use and Scope 1 and 2 emissions to include Scope 3 reporting and broader sustainability risks. Moreover, unlike SECR, the UK SRS requires forward-looking information and potentially mandated assurance in the future.

The UK government has committed to mandating certain entities to develop transition plans that align with the 1.5°C goal of the Paris Agreement. Primarily aimed at UK-regulated financial institutions and FTSE 100 companies, these plans must outline how organizations will adapt their operations and business models to meet sustainability goals. According to Bloomberg New Energy Finance, the UK will need approximately £130 billion in annual transition investment through 2050 to stay on track.

The formal process for implementing the UK Sustainability Reporting Standards involves multiple phases spanning from consultation to mandatory reporting. This critical roadmap establishes both how and when companies must adapt to new sustainability disclosure requirements.

The UK government launched its consultation on the exposure drafts of UK SRS on June 25, 2025, with the process running for 12 weeks until September 17, 2025. This consultation seeks stakeholder views on draft standards based on IFRS S1 and S2, alongside input on six minor amendments proposed for the UK context. Initially, the government will analyze consultation responses before making final decisions on endorsement. If endorsed, the government will publish the final UK SRS S1 and UK SRS S2 standards in autumn 2025 for voluntary use by any entity.

Following consultations, implementation of the UK SRS will occur no earlier than January 2026, applying to accounting periods beginning on or after this date. Currently, the Financial Conduct Authority (FCA) plans to consult separately on requiring UK-listed companies to use these standards within FCA listing rules. Meanwhile, the government will evaluate requirements for entities outside the FCA’s regulatory perimeter, considering the broader context of potential legislative changes arising from the UK’s review of non-financial reporting.

With UK Sustainability Reporting Standards implementation approaching, forward-thinking businesses are already taking practical steps to prepare their reporting infrastructure. Effective preparation requires structured approaches to data collection, analysis, and governance.

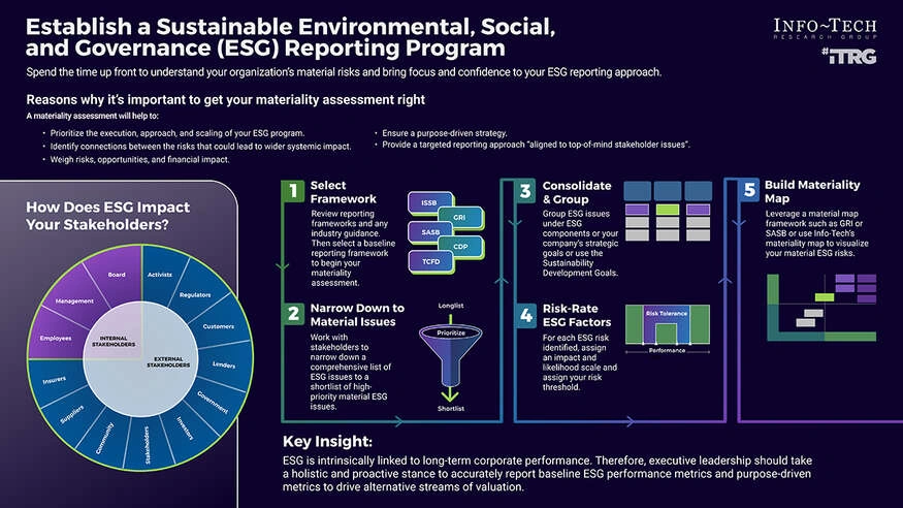

The principle of materiality forms the foundation of UK sustainability reporting standards compliance. A materiality assessment helps identify and prioritize sustainability issues most significant to your business and stakeholders. This process clarifies which aspects of the UK SRS matter most to your organization, guiding resource allocation and reporting focus. For a comprehensive approach, consider adopting the double materiality methodology from ESRS, which examines both financial impacts on your company and your company’s impacts on society and the environment.

High-quality data forms the cornerstone of effective UK SRS reporting. Putting in place ESG data collection systems that gather and organize information on emissions, governance, and social metrics automatically helps make sure your reports meet compliance requirements. Your data infrastructure should:

Sustainability reporting expertise requires specialized knowledge. Invest in training programs that equip your team with skills to integrate ESG data into decision-making processes and leverage technology effectively. Team members should understand both global and regional standards to ensure alignment with evolving regulations and industry best practices.

Organizations across the United Kingdom must now prepare thoroughly for the changes that will take place, aiming to reshape reporting practices. The phased implementation timeline for the UK Sustainability Reporting Standards offers an opportunity to develop robust reporting systems before mandatory compliance begins in 2026. Consequently, early adopters will gain competitive advantages through better risk management and stakeholder trust.

Remember that effective compliance depends on several key factors. First, conducting proper materiality assessments helps prioritize your reporting efforts. Second, establishing reliable data collection systems ensures accuracy and completeness. Last but certainly not least, training your teams on sustainability metrics creates organizational readiness for ongoing compliance. Preparation strategies should begin now, regardless of when specific reporting obligations take effect. The consultation process currently underway offers useful information about final requirements, therefore allowing companies to align their sustainability governance structures accordingly. Undoubtedly, organizations that view UK Sustainability Reporting Standards as a strategic opportunity will emerge better positioned for long-term success in an increasingly sustainability-focused business environment.